The year 2025 will be remembered as a period when financial markets performed significantly better than the underlying economy. Equities climbed a persistent “wall of worry,” reaching new highs despite a steady drumbeat of unsettling headlines: cooling job growth, fragile consumer sentiment, tariff noise, and persistent questions regarding fiscal sustainability. Yet, beneath this apprehension lies a powerful, transformative narrative.

We believe we are at the threshold of a new economic epoch, a resurgence in productivity growth driven by the convergence of Artificial Intelligence (AI), autonomous transportation, and ubiquitous connectivity. While this productivity boom has the potential to alleviate long-standing fears regarding fiscal stability and debt service, it arrives at a time of historically stretched valuations.

As we transition into 2026, the mandate for the prudent investor is clear: embrace the optimism of this technological renaissance but exercise vigilance and focus on quality necessary to navigate a market where the margin for error has rarely been thinner.

Key Themes

At a high level, six themes defined the year:

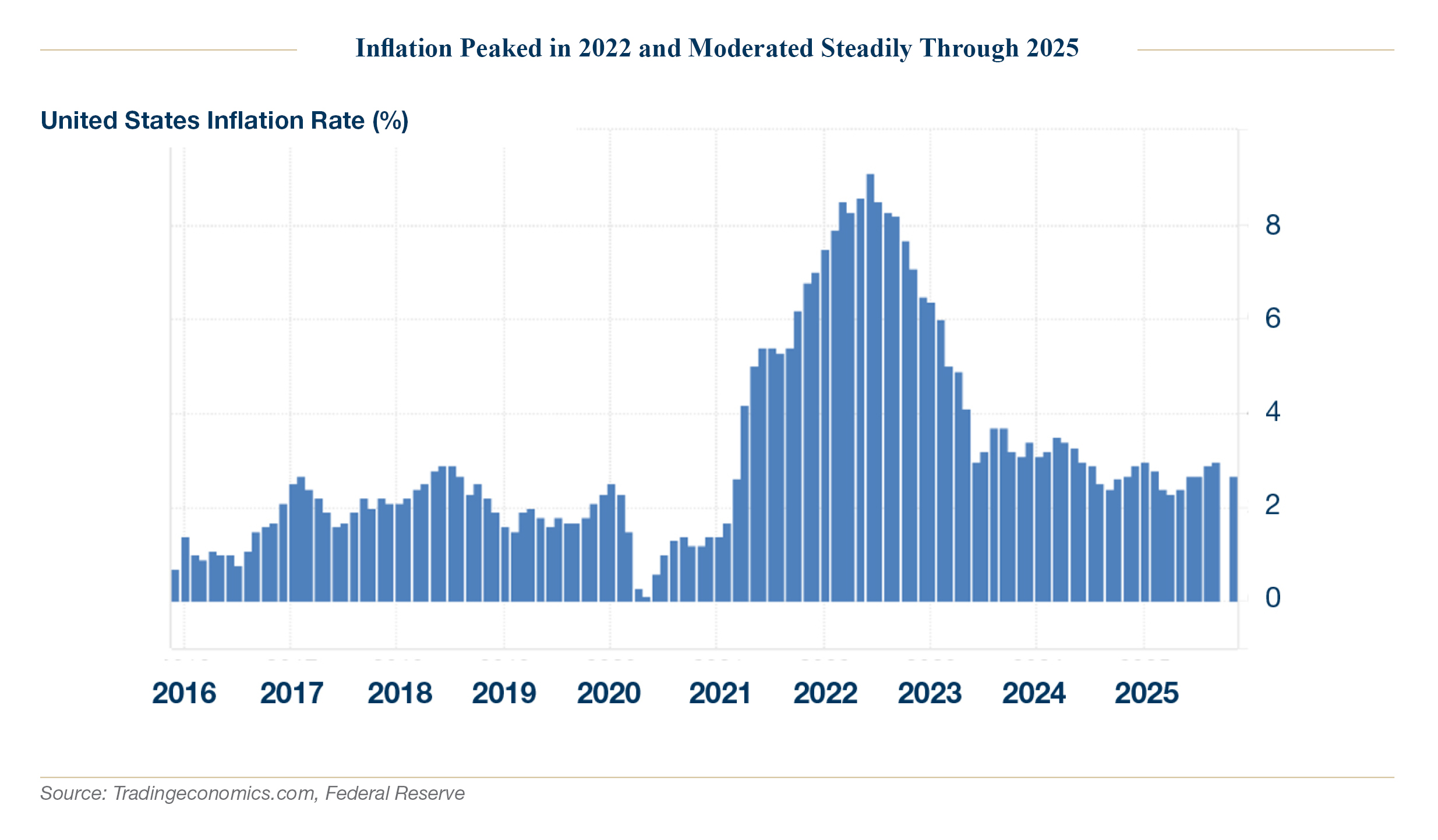

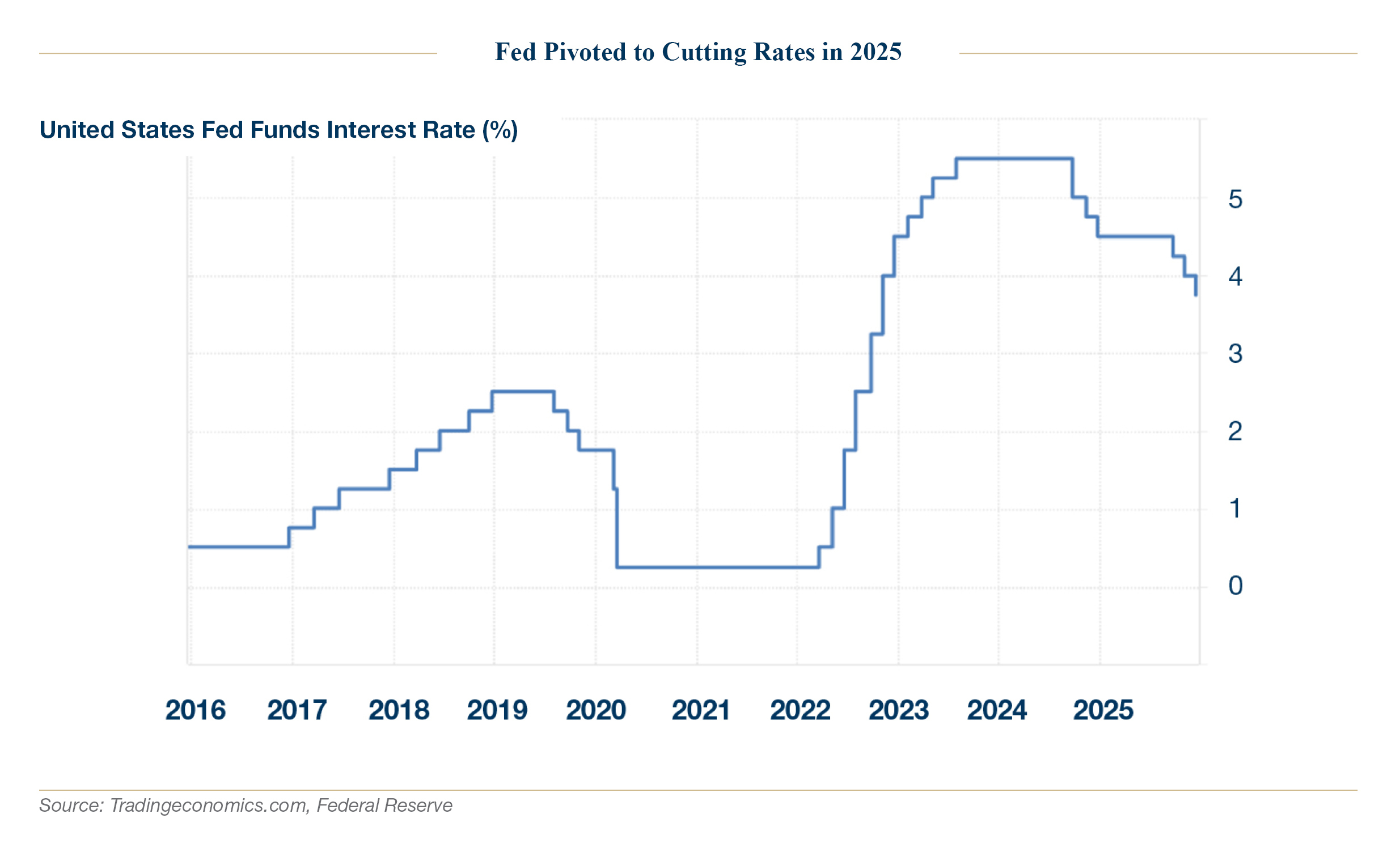

- Moderating inflation and a Fed pivot from hikes to cuts, providing important support to risk assets but leaving policy in a data-dependent holding pattern.

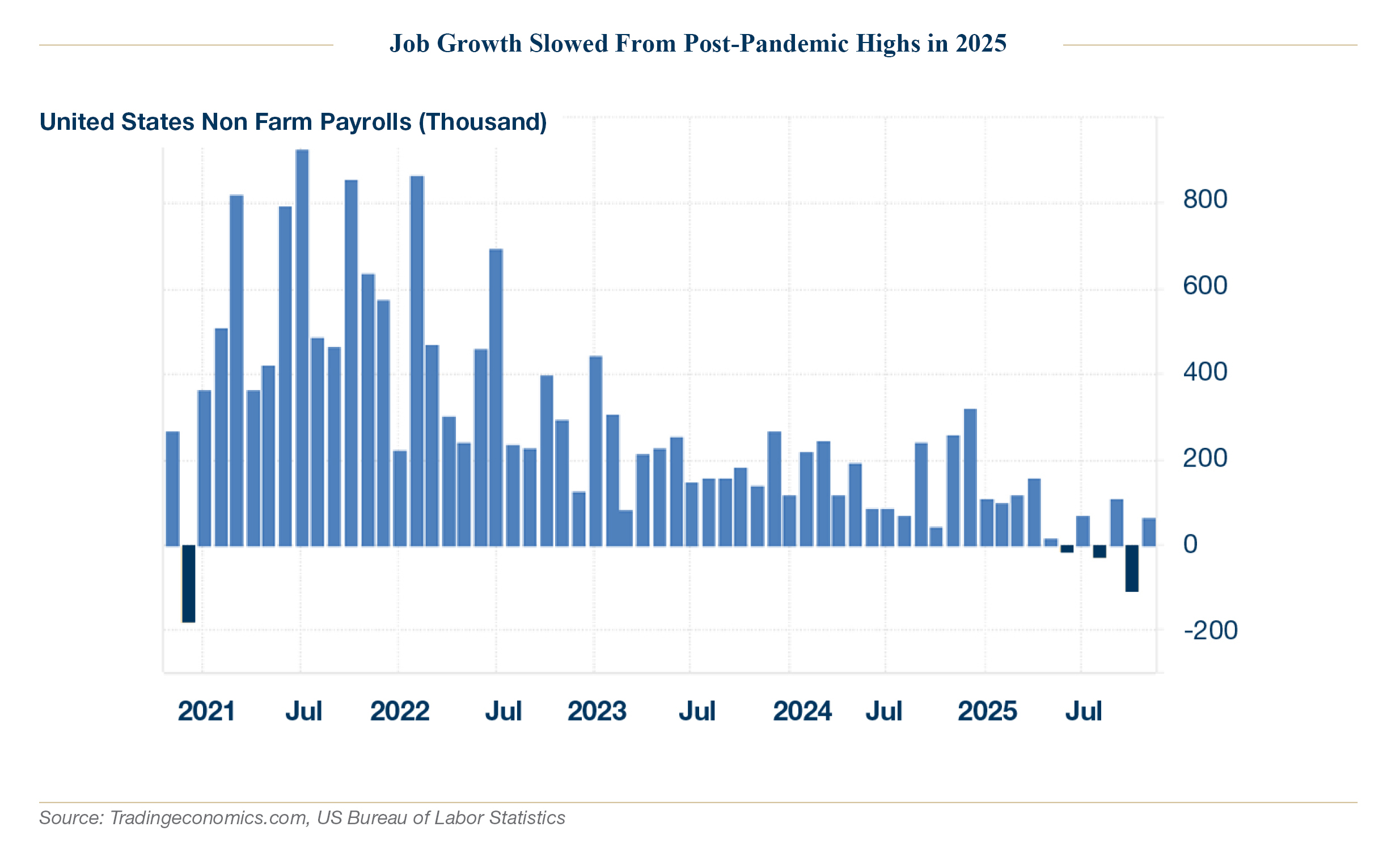

- Slower growth and softer labor markets, with job creation, wage momentum, and consumer sentiment all weaker than in prior years.

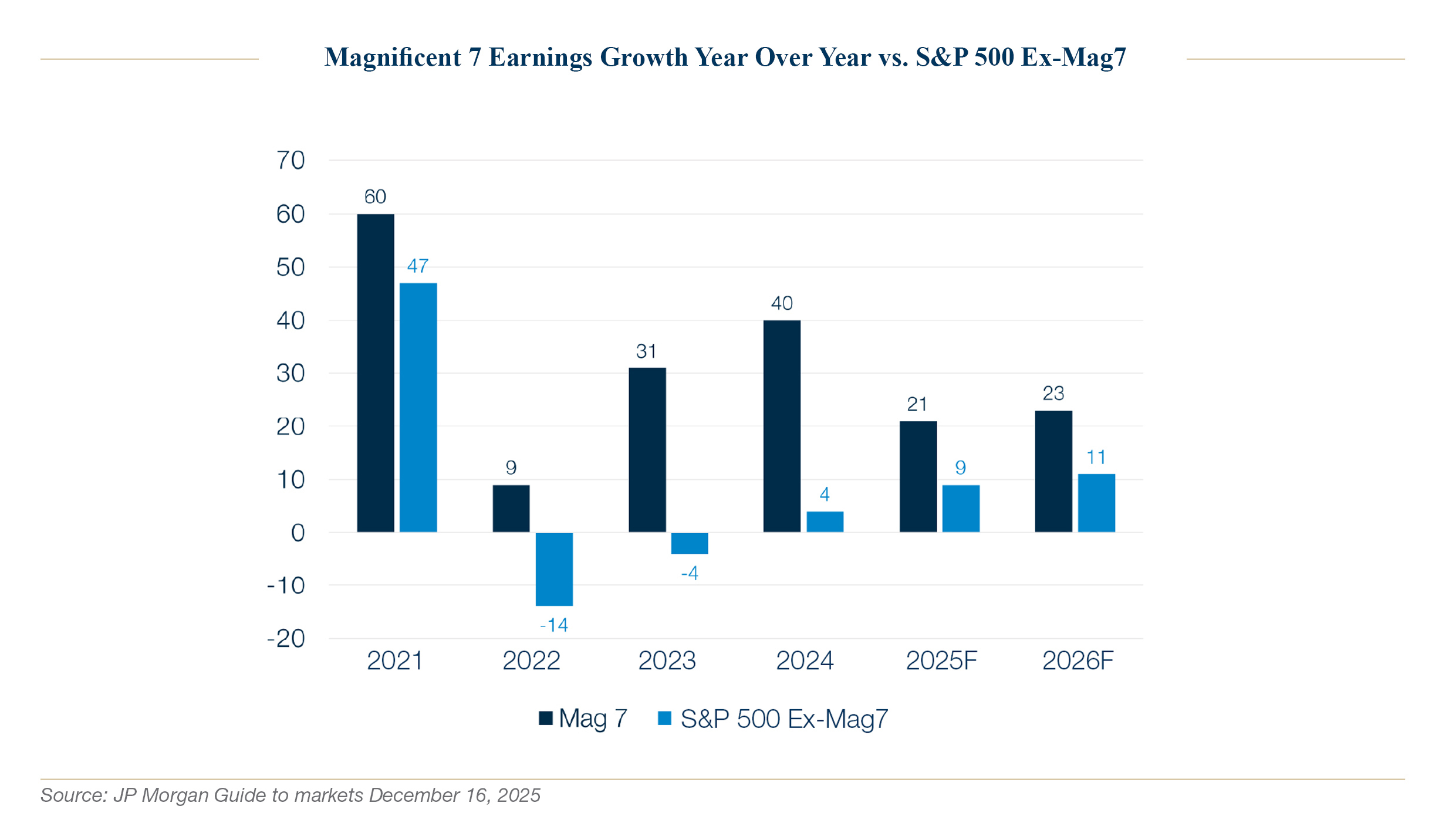

- A powerful equity rally despite already elevated valuations, leading to compressed equity risk premia and a growing dependence on continued earnings strength.

- An AI and technology investment boom, which has not yet fully shown up in aggregate productivity statistics, is reshaping capital spending and corporate strategy.

- International and emerging markets outperformance, supported by a weaker dollar, attractive starting valuations, and local policy shifts, even as underlying growth abroad remained uneven.

- A volatile but ultimately constructive year for bonds, with yields peaking on inflation and fiscal concerns before falling into year-end as the Fed began easing.

The Macro Backdrop: A Year of Resilience and Realignment

Inflation and Fed Policy: The Pivot to Neutral

Inflation was the macro story that finally started to move in the right direction. After two years of elevated prints, headline inflation fell toward the 2.5% range by late 2025, and core measures trended lower as well, even if they remained above the Fed’s formal target. Goods disinflation and moderation in shelter costs did much of the heavy lifting, while services prices stayed sticky.

With inflation cooling and signs of softer growth emerging, the Fed pivoted from raising rates to cutting them. After a prolonged pause, policymakers delivered a series of quarter-point cuts in the second half of the year, taking policy rates off their peak and closer to a neutral range. The Fed paired those moves with careful messaging: acknowledging improvement on inflation and the need to support the labor market but stressing that policy remains data-driven and that further cuts are not guaranteed. While providing a vital tailwind for bonds in the form of lower rates, the realignment in policy took concerns of equity overvaluation off the “hot seat” and ushered in a focus on earnings growth instead. At the same time, the Fed stopped well short of signaling an imminent return to the ultra-low rate environment of the prior decade.

Growth and Employment: Cracks in the Foundation

If inflation was the good news, growth and employment were the areas where cracks began to appear. Real GDP growth stayed positive but slowed compared to 2023 and 2024. Consumer spending remained the primary driver, supported by a still-healthy labor market and nominal income growth, but the pace moderated as prior savings buffers thinned and higher financing costs weighed on interest-sensitive sectors.

The labor market, while nowhere near recessionary conditions, lost some of its post-pandemic tightness. Job creation slowed considerably, unemployment drifted higher from the low 3s to the mid-4s, and wage growth decelerated. Importantly, jobless claims and broader unemployment measures did not spike, but the direction of travel was unmistakable: the balance of risk in the labor market shifted from overheating to potential slack.

Market Returns: A Snapshot of 2025

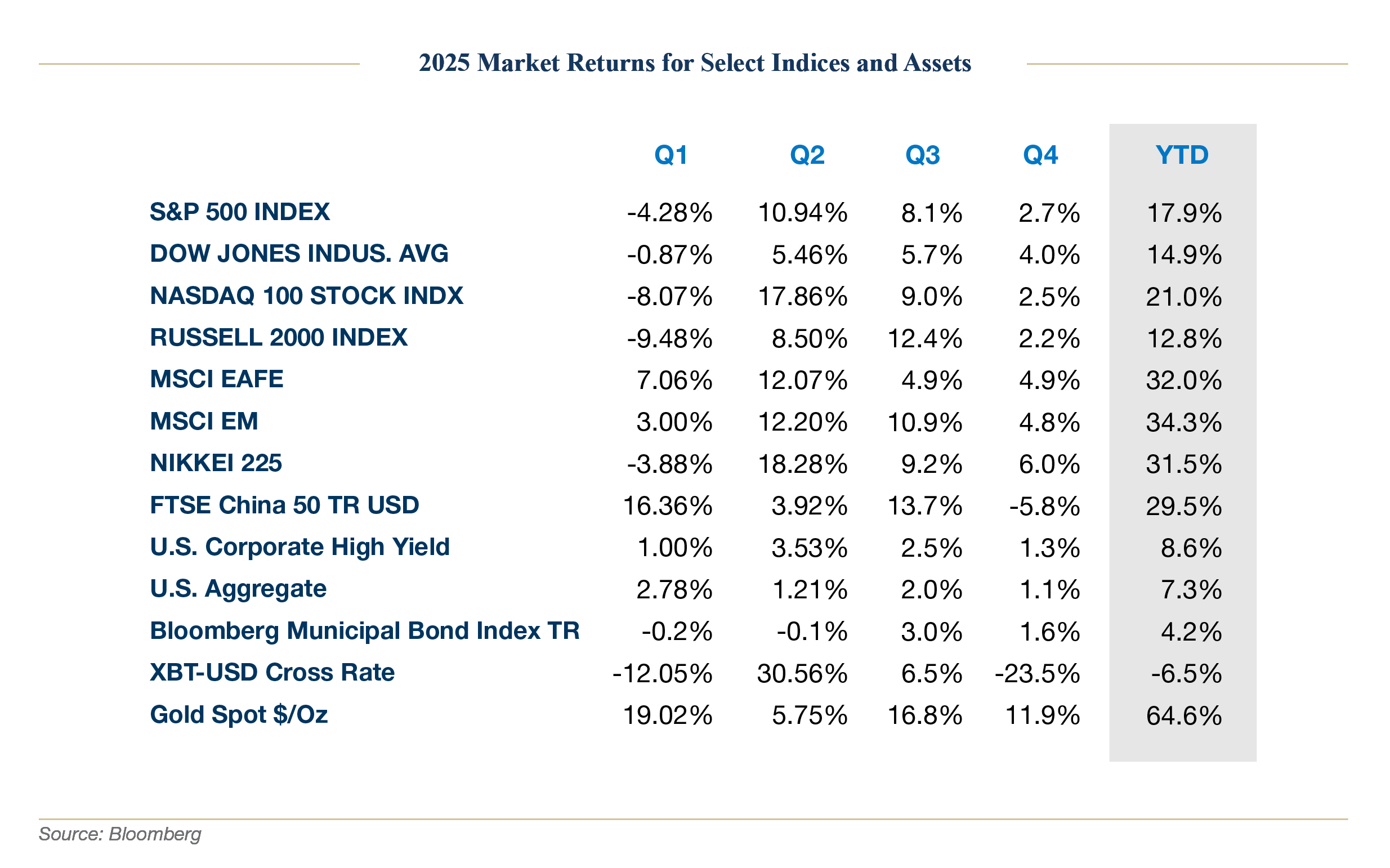

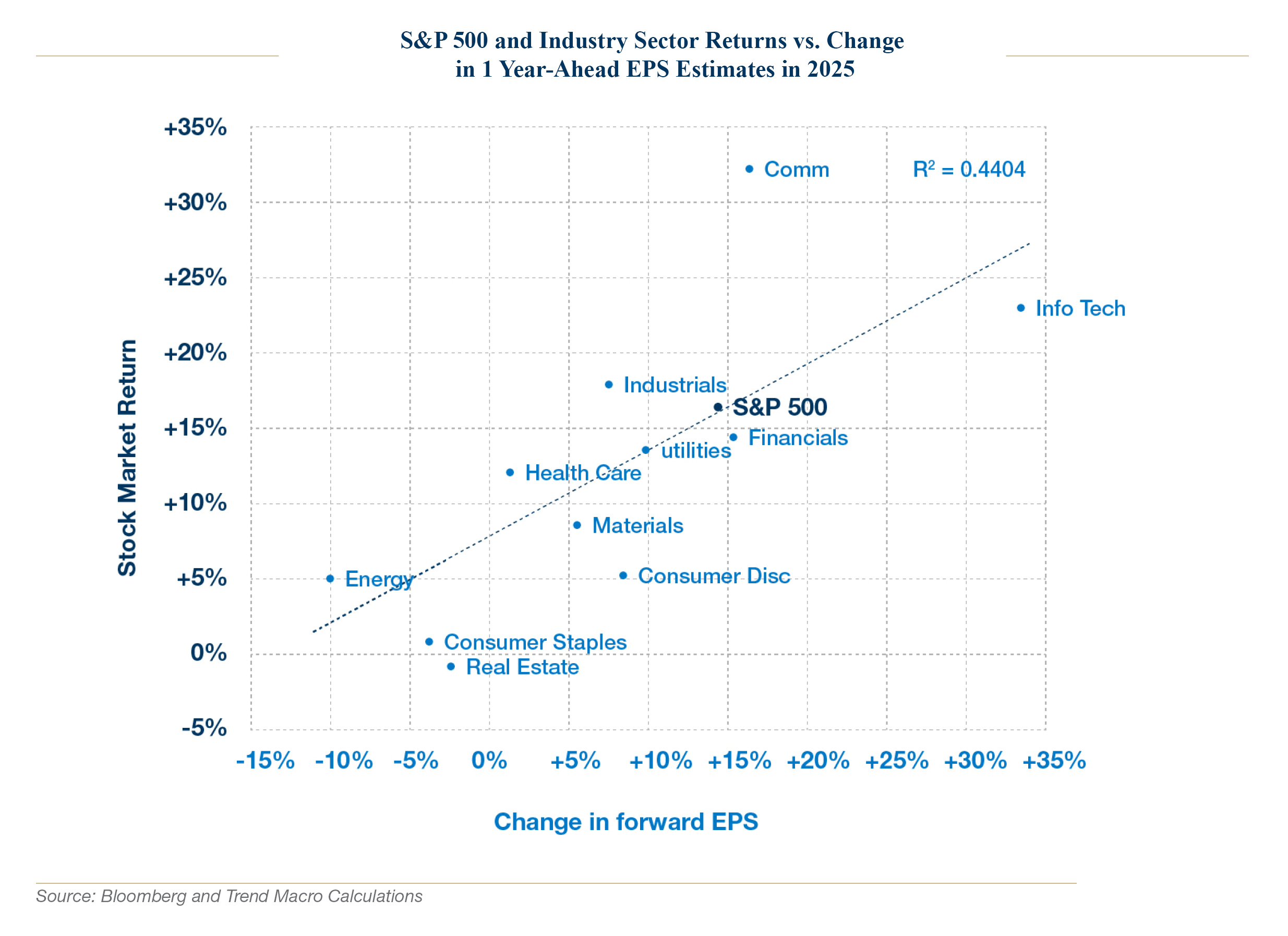

The rewards for innovation were clearly visible in the 2025 performance data. Markets favored those companies best positioned to adopt and monetize innovative technologies, with leadership remaining remarkably concentrated in Technology and Communication Services.

Equities: Narrow Leadership and Global Rebounds

Global equities produced strong returns in 2025, even as macro data cooled. U.S. large-cap indices ended the year with mid- to high-teens gains, led by the usual concentration of mega-cap technology and AI-related names. Beneath the surface, leadership was narrow. Equal-weighted U.S. benchmarks lagged their cap-weighted counterparts significantly, as Tech beneficiaries captured the bulk of investor enthusiasm.

International equities finally had a year of outperformance, supported by a weaker dollar for much of the year and less demanding starting valuations. Japanese equities appear to have largely benefited from corporate governance reforms, normalization of monetary policy, and a competitive currency. Emerging markets, after several difficult years, posted strong gains as Asian technology exporters like TSM rallied nearly 56% on the back of AI and data-center supply chain demand.

The Productivity Epoch: Solving the Fiscal Puzzle

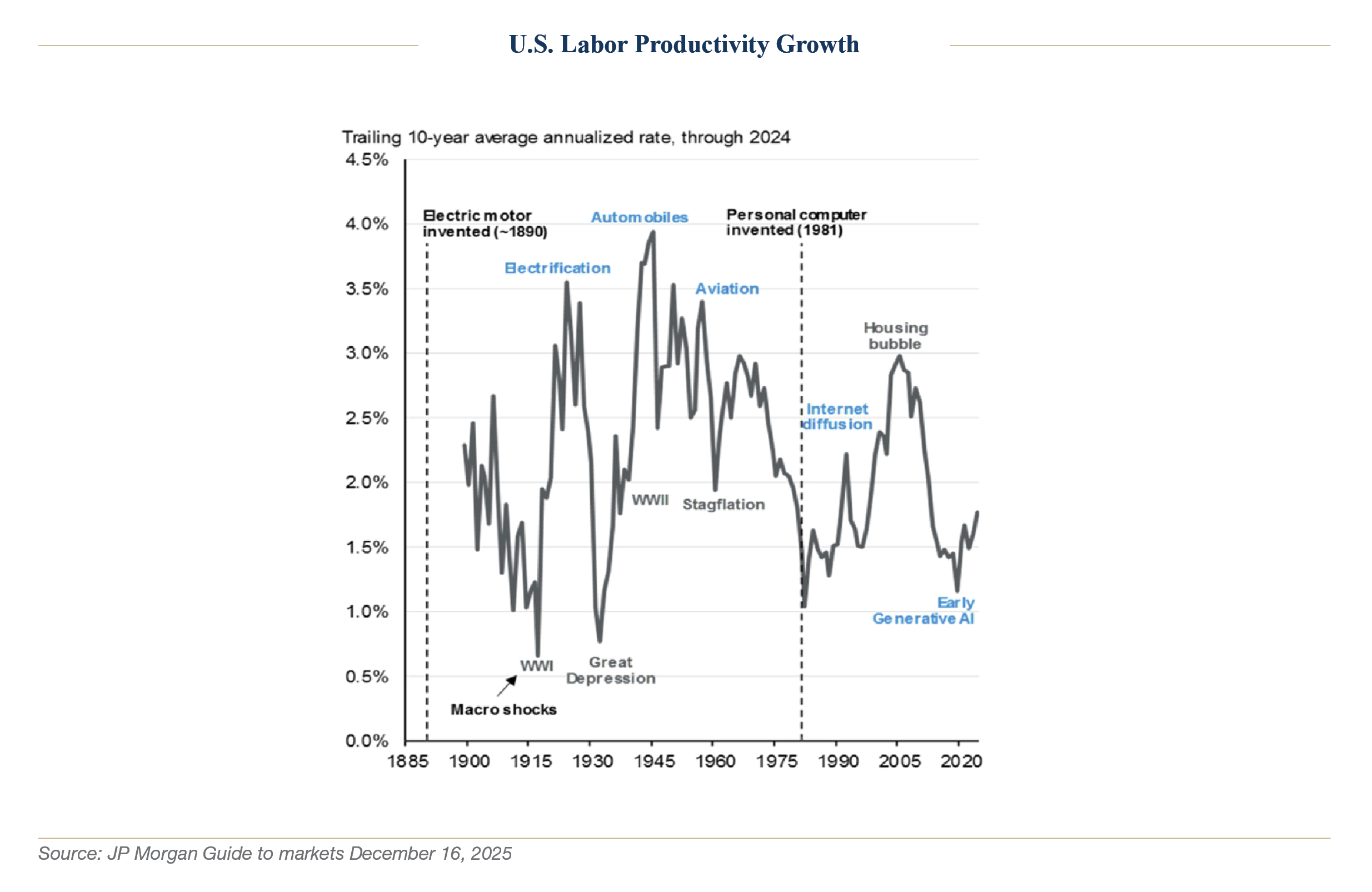

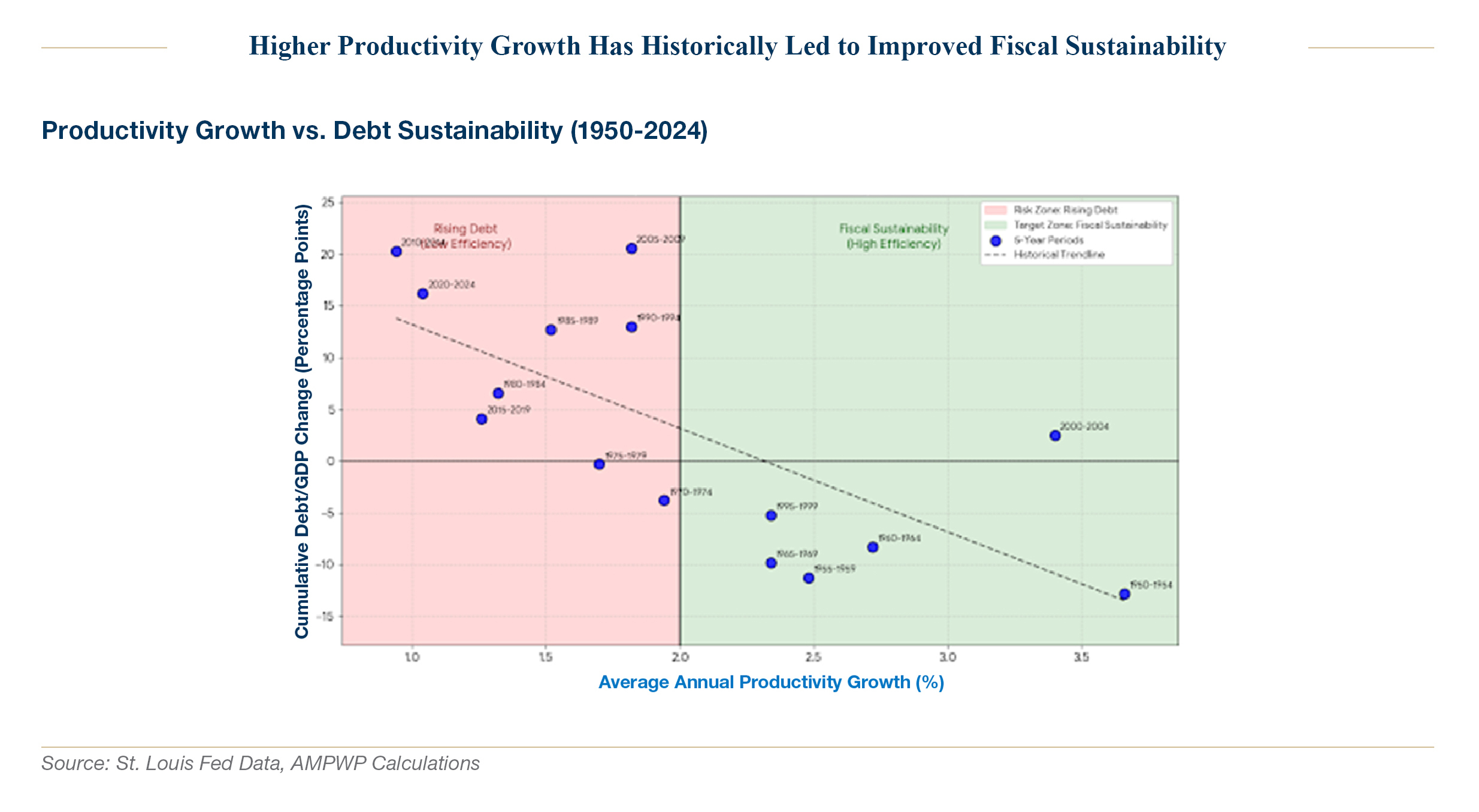

The central pillar of our constructive long-term fiscal outlook is the belief that we are entering a productivity regime not seen since the advent of the internet in the 1990s. Over the last twenty years, U.S. labor productivity growth has averaged roughly 1.5% per year, materially below the long-run postwar trend. This stagnation, coupled with an aging workforce and slowing population growth, has led to fears of “secular stagnation” and unsustainable sovereign debt burdens.

We believe the convergence of Generative AI, ubiquitous mobile communication, and logistical autonomy may provide the antidote to an expanding debt-to-output relationship. Historically, productivity surges like the late 19th-century industrial build-out or the 1990s IT boom have been the most effective tools for managing heavy public debt burdens.

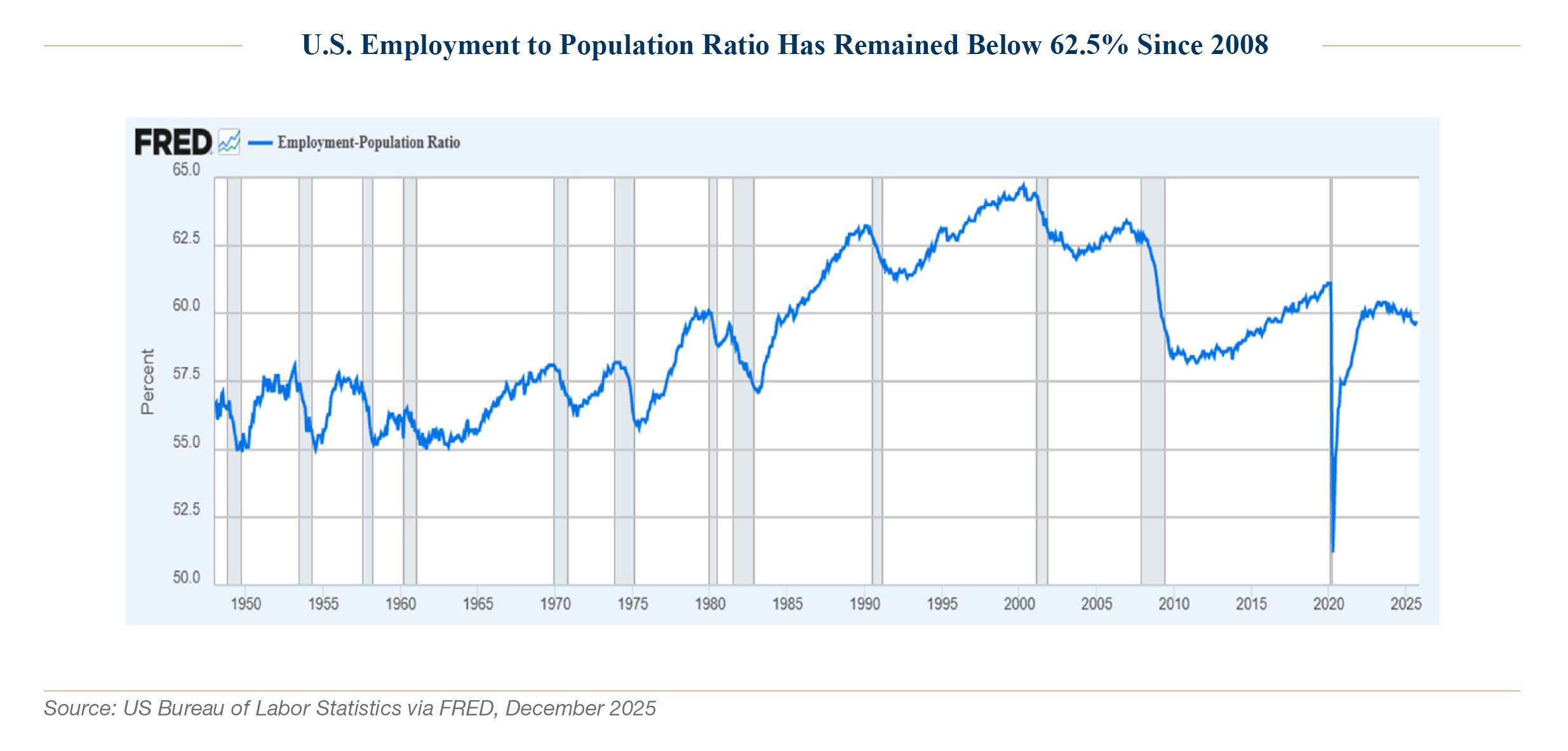

Demographics and the Case for Automation

Demographic forces are currently putting the brake on the size of the workforce. The U.S.-born population is growing at a steadily slowing rate, and participation has drifted lower as the population ages. Official projections point to very modest labor force growth ahead. In this context, the excitement around AI and automation is not just speculative; it is a mathematical necessity. If the number of workers is not going to grow fast, the way to sustain higher GDP growth is to increase output per worker.

The Denominator Effect

The fiscal implications of this shift are profound. Higher productivity typically supports above average GDP growth, naturally increasing the “denominator” of the debt-to-GDP equation, while also providing the potential for deflationary impulses, making interest payments more manageable relative to total economic output. While aggregate productivity statistics are only beginning to reflect these gains, the massive capital expenditures currently earmarked for data centers and AI infrastructure suggest that corporate America is already betting on this efficiency revolution.

Higher Productivity Growth Has Historically Led to Improved Fiscal Sustainability

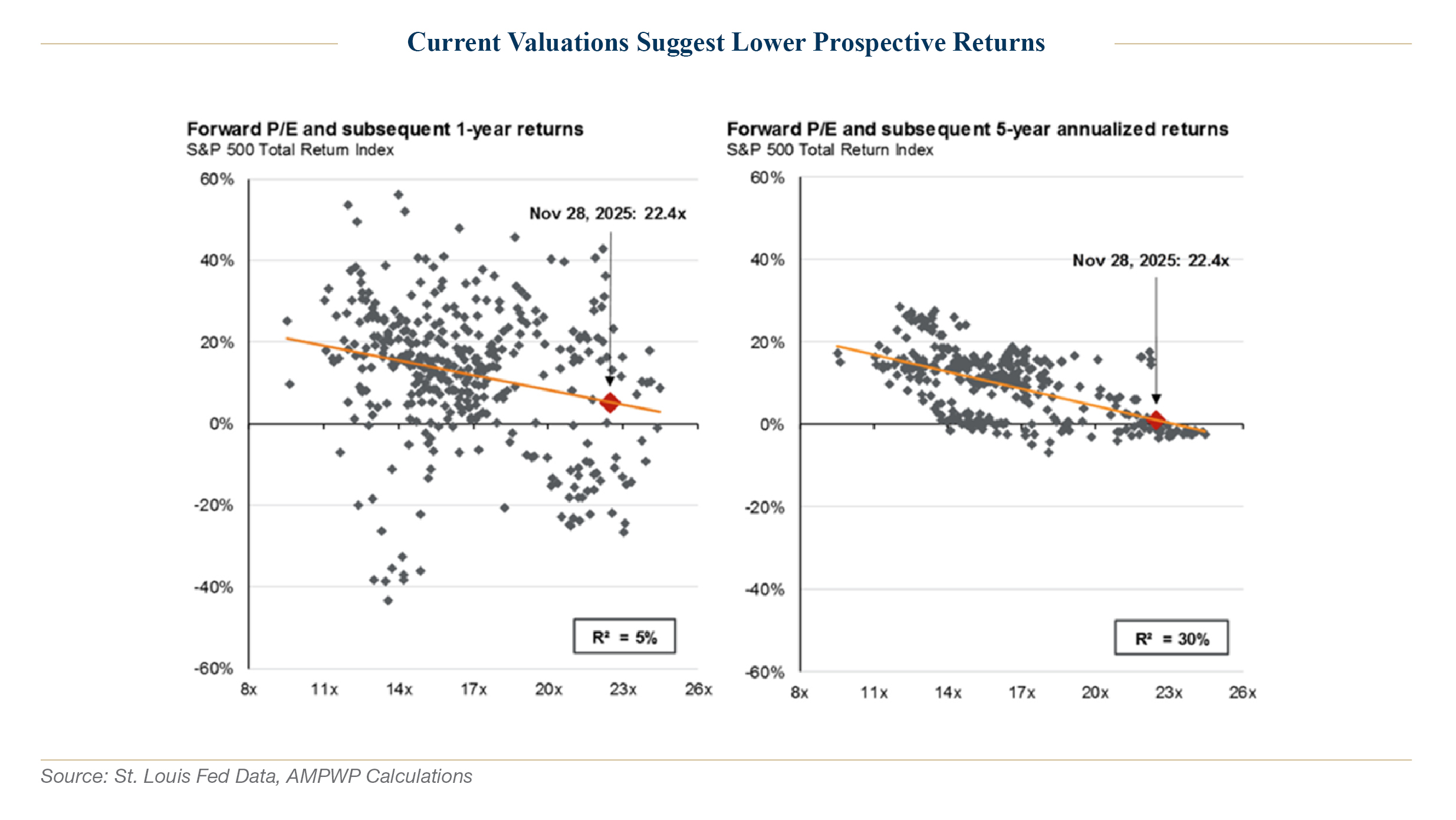

If productivity is the “hope,” then valuation is the “hurdle.” We finish 2025 with an outlook where our respect for market resilience is tempered by the reality that equity valuations are near historic highs. Forward price-to-earnings (P/E) ratios for major U.S. indices sit well above long-term averages, and Enterprise Value to Sales ratios are at all-time highs. With 10-year Treasury yields in the 4% range and S&P 500 earnings yields near 3.25%, the implied equity risk premium is negative.

This does not mandate an immediate market correction, but it indicates that the market has already “priced in” a significant portion of the anticipated productivity gains. History suggests that translating general-purpose technologies like AI into economy-wide gains takes time and organizational change. There is a real risk that market expectations are running ahead of sustainable returns, especially for firms “priced for perfection.” This is why we value quality over a blanket bet on themes. As in prior technology cycles, we expect periods of consolidation and a “weeding out” of companies that fail to turn AI hype into actual cash flow.

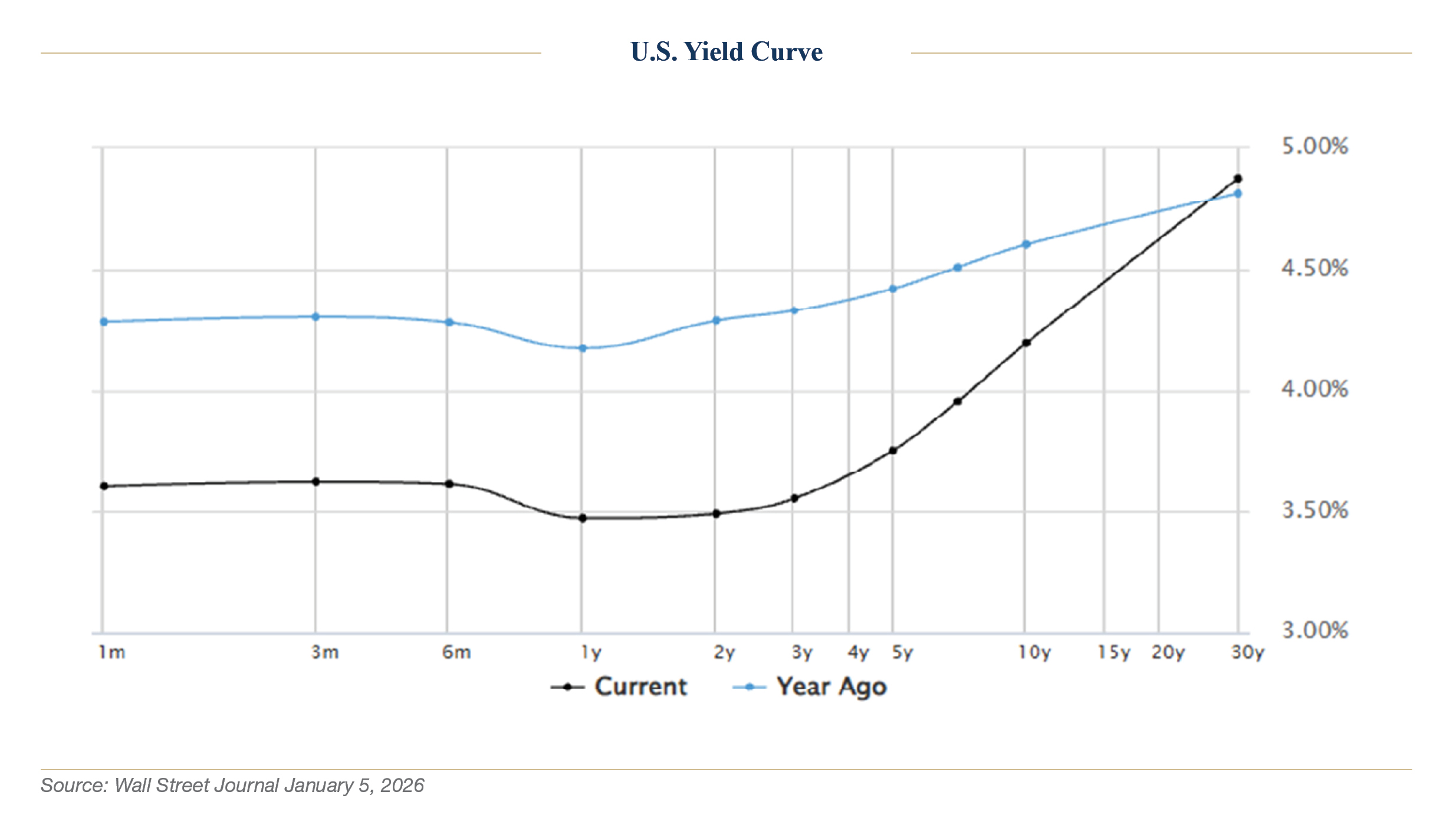

Fixed Income: A Return to Diversification

For the first time in several years, bonds provided both income and a measure of diversification. The path of yields was not smooth. Early in the year, persistent inflation, heavy Treasury supply, and fiscal concerns pushed long-term yields to cycle highs. The yield curve was still relatively flat, though no longer inverted, and volatility in rates remained elevated.

As the yield curve re-steepened in response to Fed cuts, bonds finally resumed their traditional role as a portfolio offset to equity volatility. Investors could again lock in yields in the mid-single digits in high-grade credit and near 4% in intermediate Treasuries. However, with credit spreads remaining tight, our positioning continues to favor quality and liquidity over aggressive yield-seeking. The compensation for credit risk remains thin, leaving little cushion if growth slows more than anticipated.

Manager Perspectives and Strategy

Across our external managers, the dominant tone in late 2025 was one of “cautious participation” rather than aggressive risk-taking. Equity managers acknowledged the resilience of corporate earnings but remained uncomfortable with headline valuations and narrow leadership. Active stock pickers found fertile ground in areas where prices did not fully reflect underlying strength, particularly in healthcare and select industrials.

Our strategy entering 2026 focuses on four key pillars:

- Stay Invested, but Selective: Markets can continue to rise even at elevated valuations if earnings hold up and policy stays supportive. We remain participants in the technological boom but avoid “chasing” at any price.

- Emphasis on Quality: We favor companies with strong balance sheets, recurring cash flows, and resilient business models. The ability to self-fund growth is a massive competitive advantage in an era of potentially higher-for-longer interest rates.

- Thoughtful Diversification: We are utilizing fixed income and alternatives to provide income and potential downside protection. High-quality bonds now offer a real “total return” alternative to equities.

- Grounded Expectations: We must target portfolio outcomes that reflect a more modest growth world rather than extrapolating the outlier gains of the last cycle.

Conclusion: Stewardship in a Complex Age

We are neither complacent nor bearish as we look toward 2026. The world remains a complex place, burdened by heavy public debt, aging populations, and fragmented global trade. Yet, the innovation we see in AI and automation offers a genuine, data-backed path toward a higher-growth future.

If our thesis of a new productivity epoch is correct, the “fiscal sustainability” fears that have haunted markets for a decade may eventually fade as the economy grows into its debt. However, the path there will not be linear. Undesirable valuations require discipline and a refusal to participate in speculative manias.

Our task is to steward capital by capturing the massive opportunities of this new era while maintaining the defensive discipline required when valuations provide such a narrow margin for error. Discipline, diversification, and an unwavering focus on quality will remain our guiding principles.

Disclosure

A&M Private Wealth Partners, LLC (“AMPWP”) is an SEC-registered investment adviser. SEC registration does not imply a certain level of skill or training. For additional information on the services AMPWP provides, as well as our fees for such services, please review our Form ADV at adviserinfo.sec.gov, contact us at 300 Banyan Boulevard, 10th Floor, West Palm Beach, FL 33401, or call us at (561) 268-0900.

This piece and its content reflect AMPWP’s views at the time of its writing, and the information presented and AMPWP’s views are for informational purposes only. Such views are subject to change at any time without notice including due to changes in market or economic conditions, and forward-looking statements or forecasts are based on assumptions and may not be realized. Future events and outcomes are inherently uncertain. Statements are subject to risks and uncertainties that could cause actual outcomes to differ. AMPWP has obtained information provided herein from various third-party sources believed to be reliable, however, such information is not guaranteed and is subject to errors, omissions, and changes. No reliance should be placed on the views and information presented when making any investment or liquidation decision. AMPWP is not responsible for the consequences of any decisions or actions taken or not taken as a result of the views and information presented, and AMPWP does not warrant or guarantee the accuracy or completeness of this piece or information presented.

Additional content may be relevant for further context or other insight. Portfolios should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by performance and other information. Any references to future returns and/or risk are not promises of the actual return a portfolio may achieve nor do they reflect all risks. Not all investments are suitable for all investors. All investments involve risk of loss, including to principal, and all investors must be prepared to bear such loss. Different securities, strategies, and allocations have different costs and risks, and diversification also does not assure a profit nor protect against a loss. Past performance is not a guarantee of future results. Additionally, changes in investment strategies, contributions, or withdrawals may materially alter results, as may market conditions, other factors including but limited to economic factors, fees, expenses, and events. Nothing herein should be construed as an investment recommendation. AMPWP does not provide legal, accounting, or tax advice, and AMPWP’s services are not intended to act as a substitute for such advice. AMPWP encourages you to seek the counsel of a qualified attorney and/or accountant for legal, accounting, or tax advice.