A Market Hiding in Plain Sight

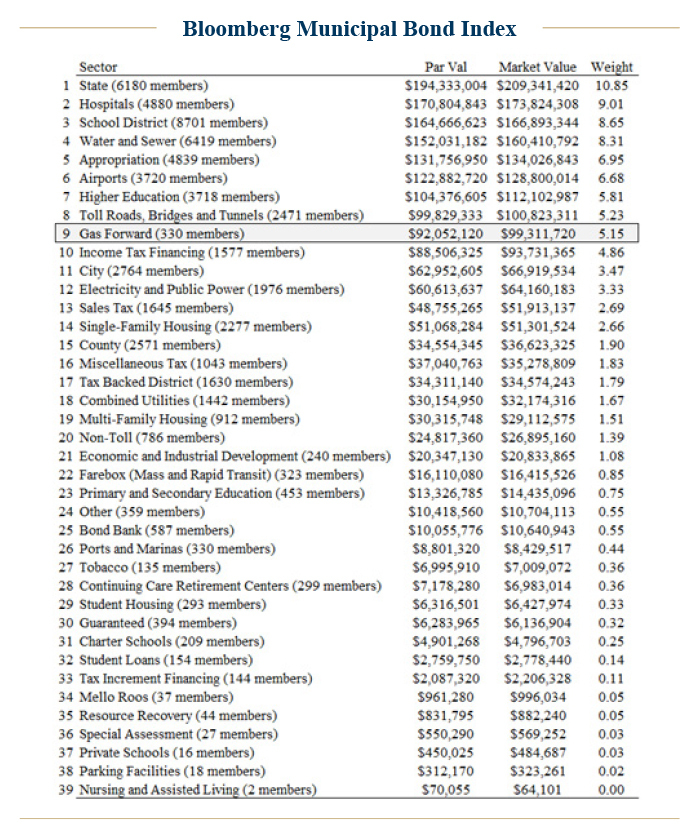

The modern municipal prepay bond originated from laws passed in Louisiana during the 1980s.i What began as a specialized financing method for public utilities has evolved into a substantial component of the tax-exempt market. 1994 was a key turning point. In December, the City of Clarksville’s Natural Gas Acquisition Corporation closed the first municipal natural gas prepayment, issuing $26.3 million of gas revenue bonds to prepay 10 years of supply from Louis Dreyfus.ii At the end of 2025, prepay structures ranked among the top ten in the Bloomberg Municipal Bond Index by market value (ranked ninth).iii The scale is no longer speculative; it is well established.

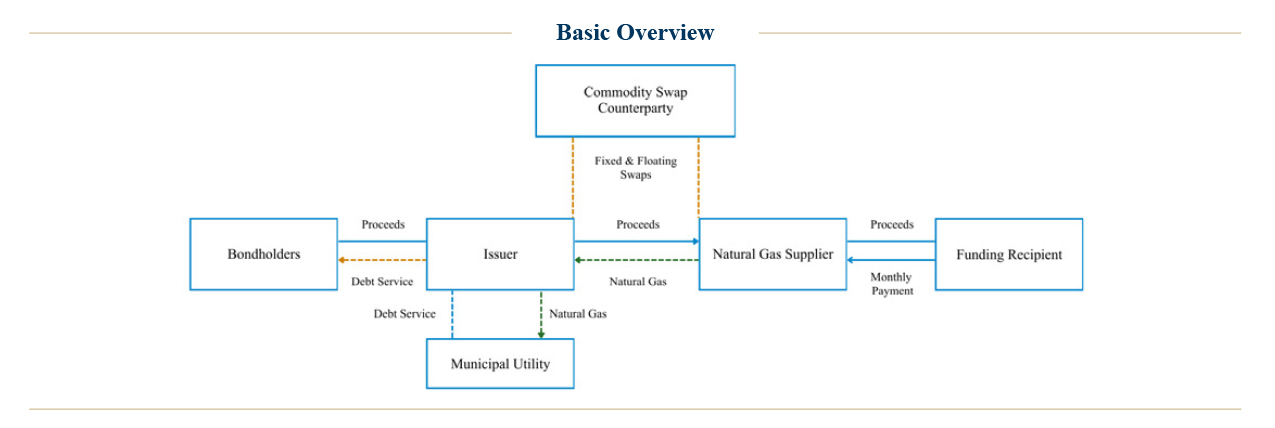

Prepay bonds sit at the crossroads of satisfying a public purpose, long-term power supply agreements, and structured finance. A conduit or issuing authority typically issues bonds and uses the proceeds to secure a multi-decade supply of commodities at a discount that a municipal gas or electric utility purchases. The utility’s retail customers benefit from a stable source of energy and or fuel supply. Investors receive tax-exempt income linked to a chain of contracts via the bond offering. The promise is orderly, but the reality requires judgment and a keen understanding of the structure.

How the Structure Works

The basic architecture is fairly straightforward to describe but complex to analyze. A public utility agrees to buy a specified amount of natural gas or electricity over a long-term period, usually 30 years (akin to buying in bulk at a discount). Bond proceeds provide the initial prepayment to an energy supplier, which commits to delivering a specified amount over a fixed timeframe. A network of swaps and delivery agreements align prices, volume, and certain risk transfers.

Public ratings often refer to the credit quality of the funding recipient (typically a financial institution). While this can be useful for assessing risk at a surface level, it can also be misleading once you dig deeper into the related bond offering documentation. The funding recipient does not guarantee the repayment of principal or interest on the bonds. For instance, structural security depends on a series of factors such as the related contracts, take-or-pay provisions related to off-takers, delivery obligations, collateral arrangements, call features, and triggers that may define a ledger event. Investors who do not review these terms are effectively investing in a name rather than a structured security and are relying on public ratings.

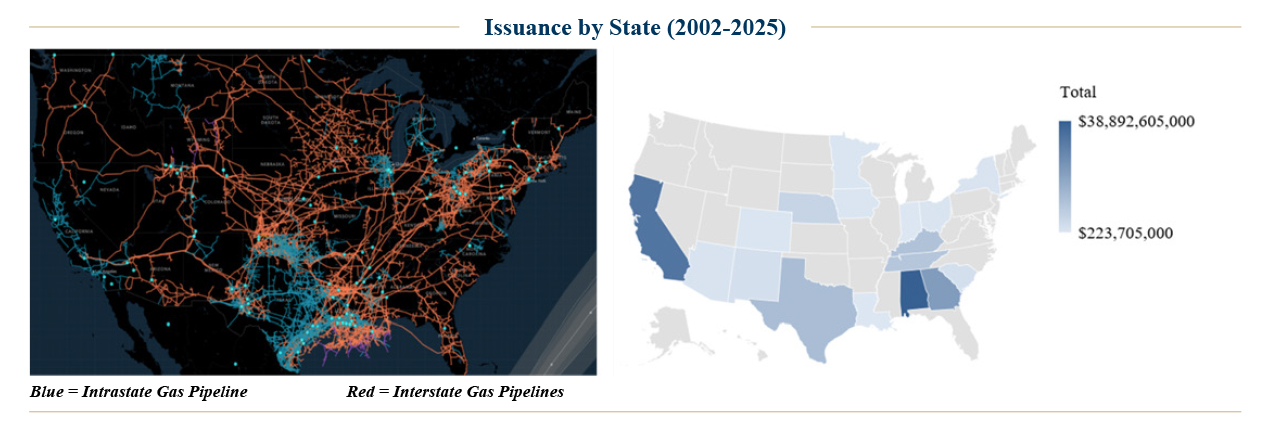

Geography Tells a Storyiv

Prepay issuance is not random. It tends to cluster where physical networks and policy preferences meet. Gas pipeline maps help explain why certain regions sponsor multiple programs. For instance, Alabama’s Black Belt Energy Gas District is one example on the natural gas side. California’s market is a leading example on the electric side, thanks to Community Choice Aggregators that have sponsored large electricity prepay programs. Infrastructure drives feasibility, and local governance and laws drive scale.

The Counterparty Shift

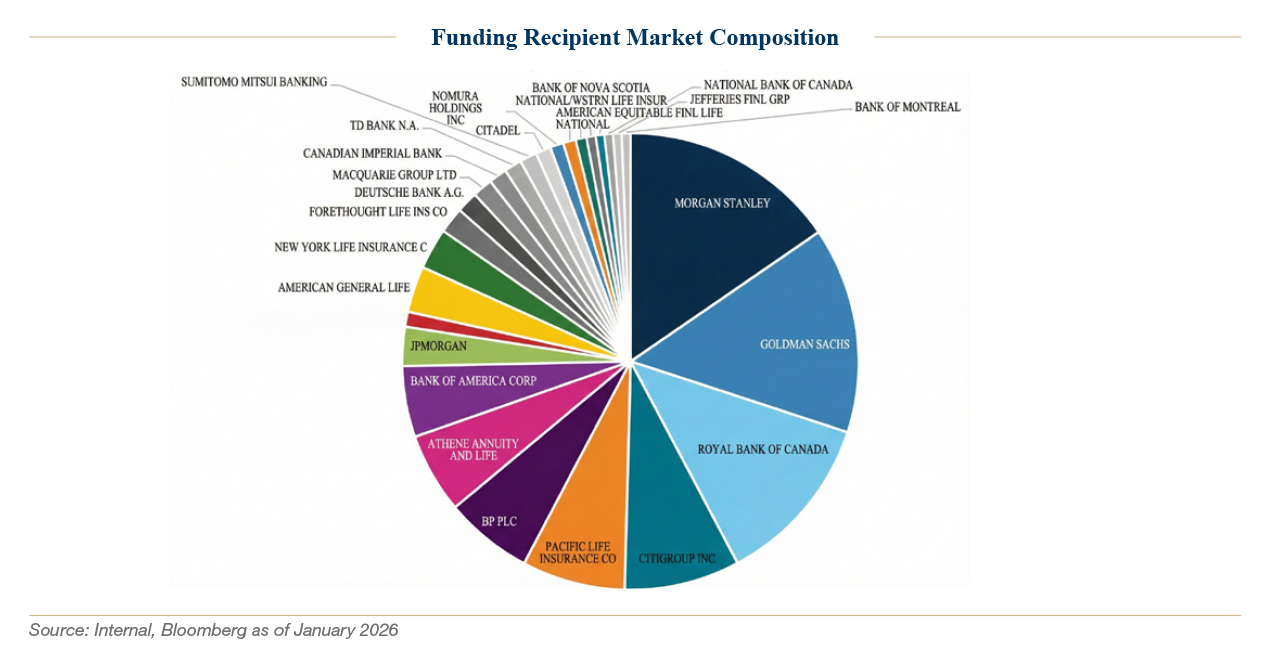

The history of funding recipients illustrates the evolution of the market. From around 2006 to 2018, major U.S. financial institutions held this role. Banks with trading and physical energy operations provided the balance sheets and execution platforms needed for prepayments. The landscape began to diversify in 2019, with Macquarie engaging in a Main Street Natural Gas transaction. BP later participated in a Kentucky Public Energy Authority deal. Royal Bank of Canada took part in a Black Belt Energy transaction in 2021. More entrants soon appeared, including Canadian Imperial Bank, Citadel, and Nomura.

The period from 2023 to 2025 marked a major turning point. Insurance companies became the largest recipients of funding. American General Life, New York Life, Athene, Pacific Life, and others participated in multiple California community choice deals and regional issuances. Banks outside the original group also entered, including National Bank of Canada, Deutsche Bank, and Bank of Montreal. The common theme was a search for long-term, well-structured cash flows that match institutional liabilities. The message for investors is clear: counterparty analysis can no longer rely on a single model.

Where We Believe the Value Is Now

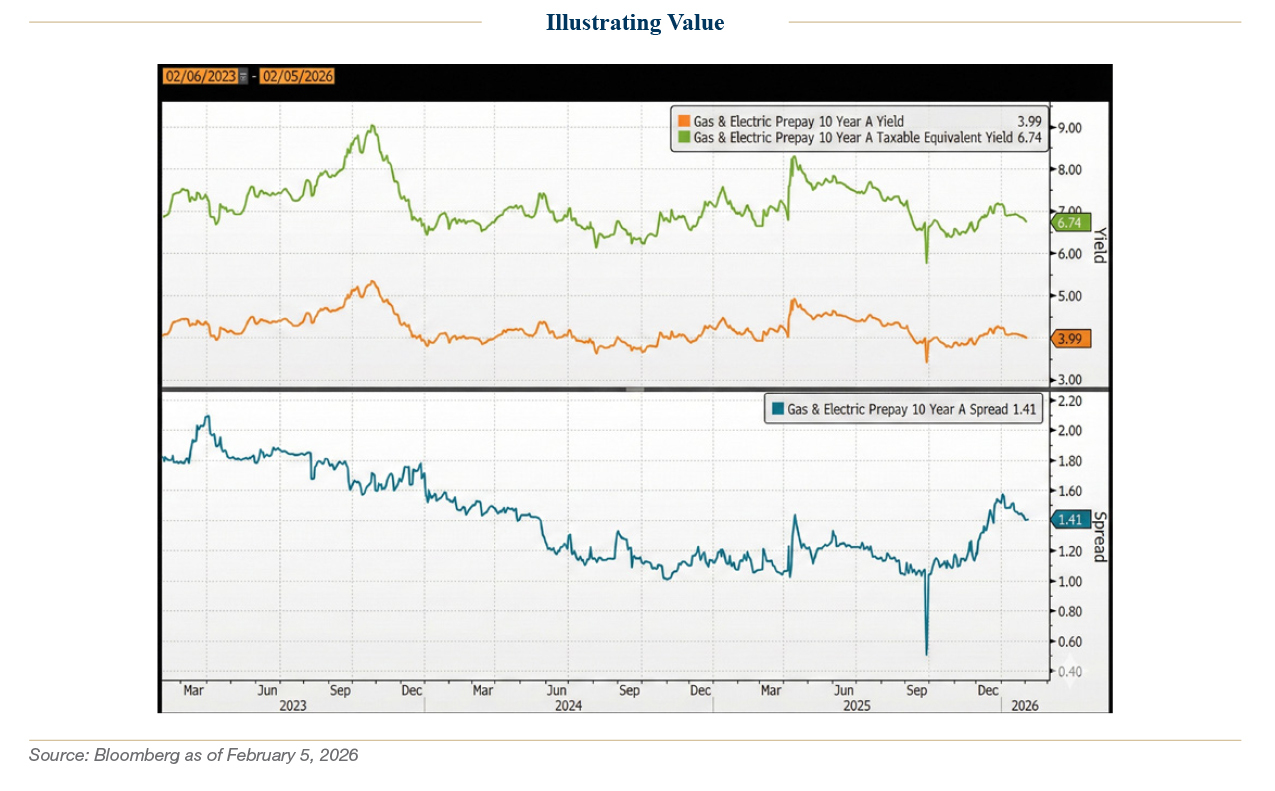

We believe there continues to be strong value in gas and electric prepay bonds. The sector exhibits high public ratings, strong liquidity, and transaction sizes that growv. Using a ten-year bond as a comparison over a three-year period, spreads have narrowed from a peak near 209 basis points in early 2023 to around 141 basis points as of February 5th. That level remains attractive both in absolute terms and compared to similar sectors. The current tax-exempt yield of approximately 3.99% translates to a taxable-equivalent yield of nearly 6.74% for investors in the highest federal tax bracketvi.

Recent market dynamics have caused a clear split in spreads. More participation from non-traditional funding recipients, especially insurance companies such as American National Insurance, American General Life, and Forethought Life Insurance, has resulted in differences of approximately 30 to 70 basis points compared to transactions with more traditional counterparties, such as Goldman Sachs, Morgan Stanley, and RBC. The structure of deals is also changing.vii Investors are seeing more use of bullet maturities in a market that has historically preferred put bonds. As bullet issues have grown, the spread gap between bullet and put structures has begun to narrow, indicating a shift in demand and acceptanceviii.

Pricing, Correlation, and Terms

Prepay bonds combine commodity, credit, and rate factors. They may trade at a premium or discount compared to similarly rated essential service revenue bonds, depending on market perceptions of the structure’s quality and the counterparty’s strength. Correlations change with market regimes. When volatility increases or structural news emerges, pricing may shift to reflect added complexity.

Traditional final maturities place duration risk directly on the investor and compensate with yield. Call provisions can either safeguard or reduce value. Ledger event definitions can stabilize cash flows or accelerate stress under specific scenarios. Two prepay bonds with similar ratings may trade very differently because the scope of risk is broader than it appears. Investors who understand these mechanics have an advantage in both bond selection and managing credit risk.

Regulation and the Tax-Exempt Question

The regulatory history is embedded in the market’s DNA. In 1999, the Internal Revenue Service expressed concern that prepays might be using tax-exempt financing to gain an unfair price advantage, causing the market to pause as rules were reevaluated. In 2003, the IRS clarified that prepay transactions could maintain tax-exempt status if utilities used at least 90% of the commodity for their own customers.ix

The policy aimed to prevent pure profit-driven resale. In 2005, Congress clarified this with the National Energy Policy Act, which included provisions on arbitrage rules for natural gas prepayments.x These measures did not eliminate all complexity, but set expectations for public purpose.

What We Believe Careful Investors Should Do

The prepay sector rewards a methodical approach. It starts with a counterparty review (e.g., off-takers and funding recipients), but it does not stop there. Investors should understand the basic creditworthiness of any swap providers and reinvestment providers. They should read how a ledger event is defined and triggered. They should study call language to match their own investment needs. They should ensure that security provisions align with the issuer’s ability to perform, rather than relying on assumptions about guarantees. Most importantly, they should test how the structure performs under stress, including commodity shocks, counterparty deterioration, or legal / tax reinterpretations.

Our Closing View

Prepay bonds are not just a curiosity. They are an ever-growing component of public finance that has evolved in tandem with the needs of utilities, the capabilities of counterparties, and regulatory constraints. The sector calls for both caution and curiosity. Caution, because the structures are complex and unforgiving if misunderstood. Curiosity, because complexity can uncover opportunities for those willing and able to do the work.

The question for investors isn’t whether prepay bonds belong in the municipal conversation. They already are. The real question is whether each transaction can be understood on its own terms, documented carefully, and sized with discipline. That’s how the sector secures its place in portfolios. The old rule still holds. If you cannot explain how a prepay transaction works, you should not own it. Remember, the funding recipient does not guarantee the repayment of principal or interest on the bonds.

ii The Bond Buyer (05.10.1996)

iii Bloomberg Municipal Bond Index as of 01.08.2026

iv Bloomberg Custom Map function

v Bloomberg Sector Issuance Detail as of 01.08.2026

vi Using a 40.8% tax rate (37% tax bracket + 3.8% investment income tax)

vii Bloomberg Sector Issuance Detail as of 01.08.2026

viii Bloomberg Sector Issuance Detail as of 01.08.2026

ix https://naturalgasintel.com/news/municipals-returning-to-prepaid-supply-deals-of-late-1990s/

x Section 1367 of the National Energy Policy Act of 2025

Disclosure

A&M Private Wealth Partners, LLC (“AMPWP”) is an SEC-registered investment adviser. SEC registration does not imply a certain level of skill or training. For additional information on the services AMPWP provides, as well as our fees for such services, please review our Form ADV at adviserinfo.sec.gov, contact us at 300 Banyan Boulevard, 10th Floor, West Palm Beach, FL 33401, or call us at (561) 268-0900.

This piece and its content reflect AMPWP’s views at the time of its writing, and the information presented and AMPWP’s views are for informational purposes only. Such views are subject to change at any time without notice including due to changes in market or economic conditions, and forward-looking statements or forecasts are based on assumptions and may not be realized. Future events and outcomes are inherently uncertain. Statements are subject to risks and uncertainties that could cause actual outcomes to differ. AMPWP has obtained information provided herein from various third-party sources believed to be reliable, however, such information is not guaranteed and is subject to errors, omissions, and changes. No reliance should be placed on the views and information presented when making any investment or liquidation decision. AMPWP is not responsible for the consequences of any decisions or actions taken or not taken as a result of the views and information presented, and AMPWP does not warrant or guarantee the accuracy or completeness of this piece or information presented.

Additional content may be relevant for further context or other insight. Portfolios should also be viewed in the context of the broad market and general economic conditions prevailing during the periods covered by performance and other information. Any references to future returns and/or risk are not promises of the actual return a portfolio may achieve nor do they reflect all risks. Not all investments are suitable for all investors. All investments involve risk of loss, including to principal, and all investors must be prepared to bear such loss. Different securities, strategies, and allocations have different costs and risks, and diversification also does not assure a profit nor protect against a loss. Past performance is not a guarantee of future results. Additionally, changes in investment strategies, contributions, or withdrawals may materially alter results, as may market conditions, other factors including but limited to economic factors, fees, expenses, and events. Nothing herein should be construed as an investment recommendation. AMPWP does not provide legal, accounting, or tax advice, and AMPWP’s services are not intended to act as a substitute for such advice. AMPWP encourages you to seek the counsel of a qualified attorney and/or accountant for legal, accounting, or tax advice.